As I contemplated investment strategies for my own trading accounts, I considered taxation. If I bought and sold in the same year, any gains would be taxed at my ordinary income rate. My income as an Itochu Salaryman wasn’t much, but even with our housing interest deduction, I’d be paying in the high twenty percent […]

Category: Investing

Venture Capitalists were well familiar with private investing; now they were joined by day-traders and on-line portfolio investors. When the truck drivers in line at McDonalds were discussing trades, we had entered a new realm.

VC Batting Average

In late December, I called Dave Carlick and suggested a meeting over golf. I’d enjoyed our previous outings and wanted to hear of his experiences at Vantage Point. Apparently he’d hit enough payouts to promote himself to VC status. We met in Marin and began that “ball and stick” game that continued to perplex. “So […]

VC Rest Stop

I remembered a conversation with Cliff Higgerson, formerly in charge of research at Hambrecht & Quist, a San Francisco Investment Bank. He had lectured at Leo Helzel’s Entrepreneurship class at Berkeley. Cliff left H&Q to start his own firm, Communication Ventures. He had done well, largely due to a couple of good hits. Almost all […]

The Kingston Crown

I read in one of the journals about Softbank buying a little company called Kingston Memory for almost $2 billion. I couldn’t fathom how a little fabricating IC house could command such valuation. If they had some kind of unique technology — making memory chips cheaper or something — then I could see it. But […]

Investing Cowboys

At my hotel I got a message to meet with some Itochu personnel in an investment division. This interested me; was it a group who might come into a deal when KV balked? More interestingly, would they back me in an independent investing venture? I asked my KV friends about IFC — Itochu Finance Corporation. […]

Selectica Afterburner

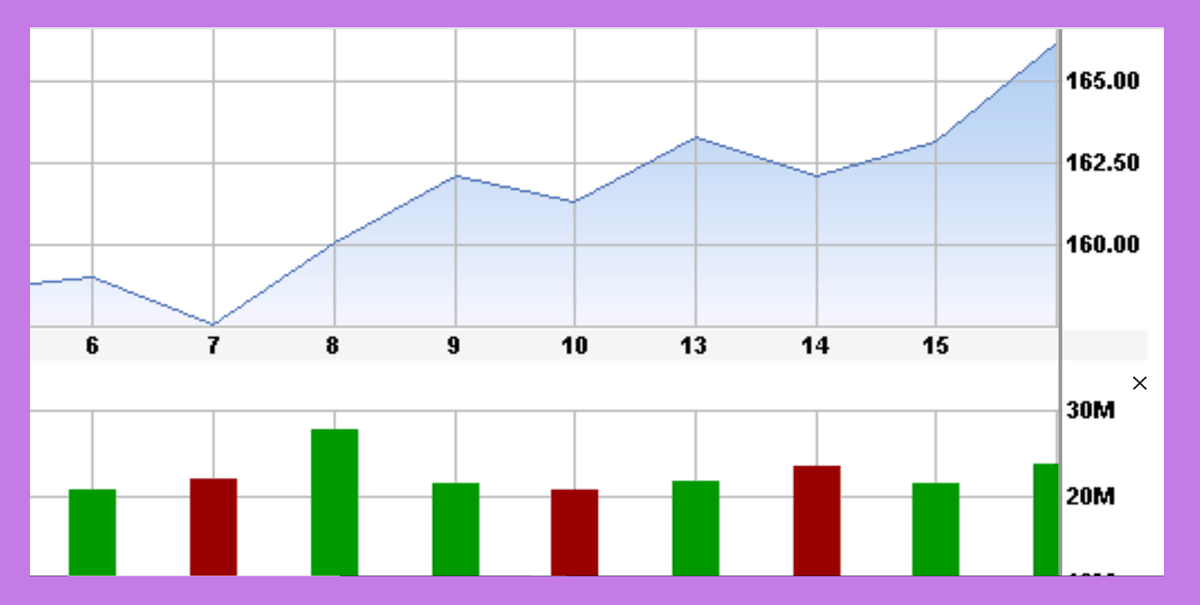

Selectica vacillated between 120 and 150 for the first few days. I was tempted to sell some, but I hesitated. I resented those well-connected few who sold their gifted IPO shares the first day or two of trading. This was known as “flipping” and seemed disrespectful, ungrateful. Financial types didn’t mind. To be truly concerned […]

Korean VC

I stopped by 2882 Sand Hill Rd. — just short of the VC bunker at 3000 — to meet with a new Korean fund, Altos Ventures. Han Kim and Ho Nam were new guys on the block with money from a single LP. I was curious about this structure; could I replicate it with Itochu […]

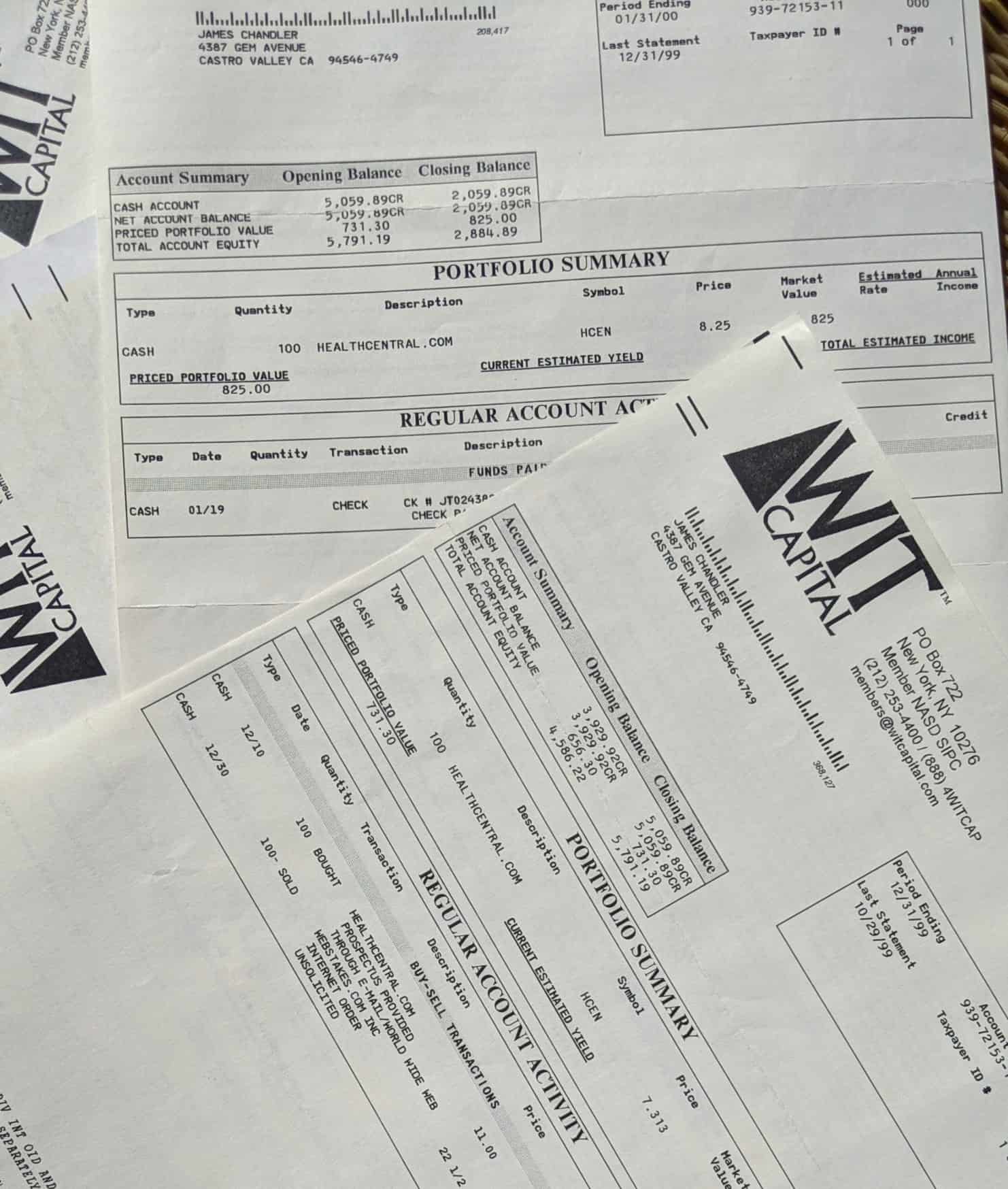

Wit Capital

With all this IPO frenzy, small investors wanted in. By the time the institutional investors had scooped up the first shares, prices were often double. Good for them; not so good for the follow-on small investor. The proletariat were protesting this favoritism toward the bourgeois. Wit Capital was an upstart on the financial block. Starting […]

Luck of the Draw

“You should come!” said Jeff Grabow, my friend at Ernst & Young. Jeff was focused on private companies and was a good “introducer” on the service firm side of entrepreneurial activity. I listened. “It’s March 5th in Palm Springs. This is our eighth year for the International Software Partnering Conference. It’s just two days: down […]